Logistic chain across the Nordics

Norway’s location might not have changed in the physical world, but from a strategic point of view, the NATO membership of Sweden and Finland following the full-scale invasion of Ukraine in 2022 has significantly altered its location in the logistics chain of the alliance.

At the same time, in the public discussions on the issue the possibilities of the existing infrastructure to handle the increased and partially rerouted flows are continuously overestimated. As such, we are looking at significant investment needs in areas which for the last few decades have often been overlooked when talking about security of supply and defence.

A brief look at the map is enough to give the general idea, the basic premise is that both Finland and Sweden are dependent on seaborne trade coming over the North Sea and into the Baltic Sea. This is particularly true for Finland, though for Sweden as well even with the presence of Gothenburg and a number of other ports of varying sizes and capabilities in the southern and western parts of the country, a number of key ports and naval facilities sit on shores opposite of the Kaliningrad exclave and the main base of the Russian Baltic Fleet in Baltiysk. With that in mind, the vulnerability of these supply lines is also obvious.

Logistics through Norway

At the same time, how vulnerable these are should not be overstated. In an all-out shooting war in the Baltic Sea, NATO has in many ways a stronger hand both when it comes to the geography, as well as when it comes to pure military strength on a potential battlefield. Events in the Black Sea have also showed that merchant vessels can and do go into literal war zones at times if the risk-reward calculations come up favourably – though at the same time events in the Red Sea have also highlighted that how mercantile flows will react to a crisis depend on any number of things and can be difficult to predict. In addition, while a full-scale conflict might play out in a certain way, the rest of the spectrum of potential conflicts in the Baltic Sea might bring other issues, such as live-fire exercises being conducted in a way that forces rerouting of traffic, vessels being boarded on false charges, and all the way up to clandestine naval minelaying.

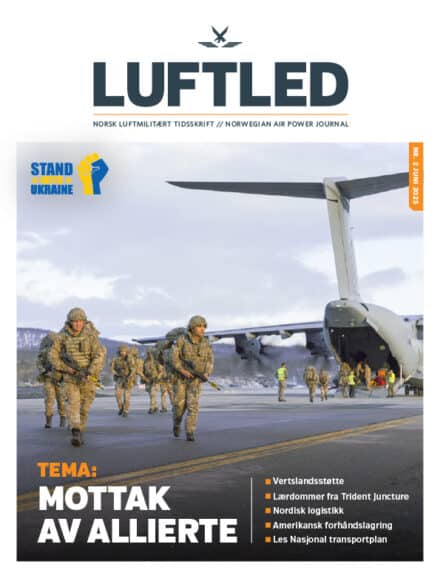

As such, there are a number of scenarios in which it would become necessary or at least preferable to transfer a greater part of logistics through Norwegian ports, which, thanks to their location, are significantly harder to disrupt for Russia. Depending on the situation, this can include both civilian goods as well as military units. Military units in particular might be of interest to route through Atlantic ports, as these are not part of the current everyday logistics flows, and as such can easily cause bottlenecks both in ports of debarkation as well as for the feeder infrastructure leading out of these – be it on the locals roads or on railways. As an example, a single standard US Armoured Brigade Combat Team with tanks, artillery, infantry fighting vehicles, and armoured personnel carrier is calculated as requiring 57 full freight trains to move. Alternatively, 2,700 lorries would handle the same amount of cargo, highlighting the stress placed on civilian infrastructure (Benefits of an alternative Öresund fixed link Helsingør-Helsingborg in a military and security perspective, 2024, Risk Intelligence).

Moving either troops or cargo through other ports than those found in the Baltic Sea would be possible through a number of different routes. Using the North German and Danish ports before transiting onto the Øresund Bridge and from there onto the Swedish road and rail networks is one possibility. This, however, would put serious strain on the bridge, which handles on average just under 2,000 lorries per day, while the railroad demand specialised locomotives able to handle both the Danish and Swedish standards for electric current, while also putting certain limits on the cargo trains due to the relatively steep gradients encountered. Note also that even getting to the Øresund Bridge means crossing both Belt-bridges and driving through the greater Copenhagen area to get there.

Not a solution in times of a crisis

Continuing North, the port of Gothenburg is the next obvious stop. The port – a giant among the ports in the Nordic countries – handle over a quarter of all Swedish foreign trade, including well over half of all container trade. At the same time, the port also handles around 5% of Norway’s container volume, again highlighting the interlinked nature of the logistics flows in the Nordic countries. The big question for Gothenburg is the room for growth in the case of a crisis, both for the port itself and for the routes leading east and north out of it. To some extent this can obviously also be complemented by other ports in the southern parts of Sweden – key among these being e.g. Trelleborg, Helsingborg, and Malmö – but the same issues are evident here, with the goods quickly being funnelled into some of the busiest parts of the Swedish land logistics infrastructure in the Gothenburg-Stockholm-Malmö triangle. The same goes for the Norwegian ports south of Trøndelag, which would in essence feed the Swedish transport network through the roads leading east from Oslo.

As such, it is natural that many have looked at the maps and confidently stated that this would mean that Norwegian ports such as Trondheim and Narvik will see a significant growth in traffic in times of crisis. However, despite what some would like to claim, rerouting e.g. Finnish trade through a Norwegian port is not a feasible solution. All the ports that make up the Trondheim port company handle approximately 2.5 million tons of gods annually, while the Finnish ports handle approximately 95 million tons in total. You may argue that comparing a single Norwegian port to all Finnish maritime trade is an unbalanced comparison, and you would be correct. Which is also the reason why diverting Finnish logistical flows through a foreign port is not a possible solution in times of a crisis. And that is even before we have started looking into the amount of road and rail infrastructure it would require to move the goods from the port to its eventual destinations.

At the same time, there are no other single solution either that magically will replace all NATO-aligned merchant shipping in the Baltic Sea in case of a crisis, and that is why the topic is important to spend some more time on compared to just quickly looking at the maps to identify ports and roads.

Business as usual?

It is clear that a serious disturbance in the trade flows of the Baltic Sea will create a need for multiple different actions. First and foremost of these is the authorities – in case of armed conflict spearheaded by the allied navies and air forces – trying to ensure that as much as possible of the goods can continue to be transported on sea to the intended destinations. Merchant shipping is simply too efficient a mode of transport compared to the alternatives, meaning that outright replacing it is impossible in the short term, something that is particularly true when the rest of the logistics chains have been built up around it. At the same time, it also seems evident that ensuring business as usual might not be entirely possible, and depending on the exact scenario delays or shortfalls in capacity will mean that some of the current flows would be diverted to other routes. For certain goods increased reliance on air freight might be a solution, but for many cases it will mean relying on other ports of debarkation and a longer part of the journey taking place on wheels, either road or railway ones. Finally, some of the flows will likely be cancelled, either because the transport capacity isn’t available or because the increased cost and complexity mean that the demand isn’t there. However, all of these actions would have an impact on Norway’s role.

Where to use the resources

If we break it down to the different parts of the solution presented above, the efforts to make sure that as much traffic as possible can keep transiting the Baltic Sea would in all likelihood mainly be handled by the states around the Baltic Sea. However, it is valuable for Norway to recognise that some of its closest allies would spend significant resources on the mission, as those resources obviously would not be available to perform missions that might be of more direct interest to Norway – such as reinforcing naval forces in the North Atlantic or flying air defence or ground support missions over Finnish or Norwegian territory. At the same time, Norway’s focus on the air and sea war also means that there certainly are capabilities that might be of interest to the Battle for the Baltic Sea – such as mine-countermeasure vessels, P-8 Poseidon maritime patrol aircraft, and JSM-equipped F-35A flying anti-ship missions. As such, it would not come as a complete surprise to see Norwegian units involved in the operations, with other allies in turn backing up Norwegian forces over the High North.

Available ports and infrastructure

The part of the logistics flows having a greater direct effect on Norway would be the shift to alternative ports, a scenario that also include any major reinforcements coming to the region from outside of the three Nordic countries involved. According to Kystverket, no less than 3,000 different ports and port facilities are in use by shipping in Norway, but far from all are suitable for this purpose. This means that identifying which actually are of interest and then planning accordingly is crucial. From a Finnish point of view, the northern half of Finland, the northernmost parts of Sweden, as well as Nord-Norge constitute a single common theatre of operations. The region also hold additional importance, as it offers the land routes through which supplies and units can be brought into Finland, mainly over the border from Sweden, although additional border crossings are found in the north between Skibotn-Kilpisjärvi and Alta-Enontekiö (in addition, there are road crossings even further east, but these would in all likelihood not offer safe routes in the kinds of scenarios discussed here). As such, identifying Norwegian ports of interest is largely down to checking where there is available infrastructure for shifting the goods east to the northern parts of Sweden and Finland.

Despite what some would like to claim, rerouting Finnish trade through a Norwegian port is not a feasible solution. All the ports that make up the Trondheim port company handle approximately 2.5 million tons of gods annually, while the Finnish ports handle approximately 95 million tons in total

he E14 to Sundsvall, Bodø connecting over E6/ road 77/ road 95 to Arvidsjaur and from there onwards to Luleå and Skellefteå, and Narvik with Ofotbanen and E10 to Kiruna from which you can reach the Swedish major garrison town of Boden and continue to the border crossing of Haparanda/Tornio. Trondheim, Bodø, and Narvik all also have access to major airports as well, further increasing their value as logistics hubs by connecting sea, air, road, and railway. However, there are a number of other interesting locations as well, with e.g. Mosjøen and Mo i Rana both offering port facilities and regional airports, as well as a straight road to Umeå in the form of the E12. Similarly, Tromsø offer a possible port and airport connecting the northernmost areas of Finland and Sweden to the outside world through E8.

Cross-border infrastructure

These considerations are far from pure hypotheticals, as shown by the recent Finnish decision to begin formal planning during 2025 for laying a European gauge railway – Finland has the old Russian gauge which at 1,524 mm is wider than the 1,435 mm standard – from the Swedish border to Kemi, and possibly onwards to Oulu as well as to Rovaniemi. The latter is of interest as one of the main locations for the new NATO Forward Land Forces and as the main logistics hub of the Finnish High North. However, while the Finnish part of such a project would not be insignificant – the planning alone is budgeted at 20 million Euro (235 million NOK) with any eventual building of tracks to Oulu and Rovaniemi costing billions of euros – it is hard to shake the feeling that the Finnish planning might not fully take into account the state of the infrastructure in Sweden and Norway. The expectations from Finland for both host nation support by Norway and Sweden for transiting units and military equipment, as well as being able to receive supplies over what in many cases are small and winding roads might not be aligned with the situation on the ground in Norway and Sweden. In turn, this raises questions about funding for cross-border infrastructure where from a Swedish point of view traffic between Norway and Finland puts a strain on Swedish roads and railroads, but it would be Norwegian ports and Finland as the eventual destination that would reap the largest benefits.

As such, at a time when the armed forces of the countries involved are actively training for a number of joint missions to be able to work together in times of crisis according to common operational plans and common tactical procedures, we are in need of a similar system for civilian logistics and infrastructure. We need close cooperation between authorities and companies involved, ensuring that everyone share the same picture for which logistics flows would shift where, and what that means in practice. Which parts of the infrastructure need improvement, and where are the bottlenecks? In particular the bottleneck question need to be discussed as part of a complete framework, as it is entirely possible that what at first glance looks like the logical choice for a logistics route might in fact be hampered by a key part of the route already operating at or near maximum capacity. If this is the case – Ofotbanen/Malmbanan might be the prime example of this – one either need to acknowledge this and shift focus to another mode of transport, invest in increasing the capacity, or use another logistics node as port of debarkation.

Securing logistic routes

Another significant question is who is responsible for the security of the logistics routes in a crisis? This include both high-end capabilities such as ground-based air defences and counter-SOF operations, but also more civilian tasks such as assisting in coordinating movements on the ground in a situation where the normal workforce might be hit by labour shortages due to reservists having been mobilised at the same time as the amount of goods shifted is increased and outside adversaries tries to disturb the flow in different ways. All of this can be improvised but planning and training usually lessen the amount of friction and ensures a more efficient and timely operation.

At the end of the day, what Finland – and to some extent Sweden – will be looking for is an ally to fight side-by-side with at the northernmost flank of the continent, but importantly also a transit country able to ensure the safe and secure delivery of not only military units and equipment but also civilian supplies via Norwegian ports and eastwards. This raises questions about e.g. the number of ground-based air defence batteries coming to the Norwegian armed forces, but perhaps more importantly it creates a need for cross-border cooperation on questions which have so far not been part of regular Nordic military cooperation at this scale. This include not only joint planning but also realising that the answer might be closer cooperation than we traditionally have seen, such as handing over the responsibility for host nation support and port security for a Norwegian port handling a significant amount of traffic destined for Finland to a Finnish unit.

We are living in a new time where all the Nordic countries are seeing new requirements placed on them. The best answer to meet these challenges is to do it together in close cooperation.