China’s space program

In January 2019, China became the first country to land a spacecraft on the far side of the Moon. This achievement brought global attention to China’s space program and raises significant questions about China’s current capabilities and ambitions in space.

China’s space program is not a recent phenomenon. Chinese leaders going back to Mao Zedong have pursued space related projects and by 1970 China had successfully put its first satellite, the Dongfanghong 1, in to space. In 2003 China became only the third country to put a person in space, successfully sending Chinese Astronaut, Yang Liwei into orbit around the earth. By adopting a long-term, deliberate and incremental strategy, China has seen substantial improvements in its launch, satellite and exploration capacities. Beijing now has a set of reliable space technologies that have a wide range of civil, commercial and military applications.

Although China remains behind the US in terms of capabilities, Beijing continues to invest heavily in its space program and has set an ambitious target of becoming a major space power by 2045. China’s pursuit of both civil and military capabilities should not be ignored and will have substantial strategic implications for the world.

China’s Drive for Space

In many ways China’s space program reflects the state’s emergence as a great power. For leaders in Beijing the operationalisation of an effective and advanced space program is seen as a requirement for a modern, developed state. China’s 2016 space white paper stated that the goal is,

To build China into a space power in all respects, with the capabilities to make innovations independently, to make scientific discovery and research at the cutting edge, to promote strong and sustained economic and social development, to effectively and reliably guarantee national security.1

The indigenous development and operationalisation of space technology provides China with the ability to sustain its development as an advanced, high-technology, connected society. China utilises space to support land-based functions including navigation, communications, earth mapping and meteorology and to both demonstrate and further its technological and scientific prowess. More recently, China is also seeking to leverage its burgeoning space program for commercial gain, opening some space functions to the private sector and looking to compete with the US and other states in the pursuit of space-related business.

These state and commercial drivers are almost inseparable from the military rational behind China’s space program. China’s 2015 defence white paper reveals China’s military perspective on space stating:

Outer space has become a commanding height in international strategic competition. Countries concerned are developing their space forces and instruments, and the first signs of weaponization of outer space have appeared.2

Although China publicly disavows the weaponization of space, Beijing actively seeks to leverage space-capabilities for strategic effect. Their military and dual-use civilian space capabilities facilitate its pursuit of advanced C4ISTR capabilities and is an enabler for military modernisation.3 Importantly, China has noted the advantages the secure use of space provides to the US and its allies and will actively seek to deny that use in any conflict scenario.

Space Organisations

Unpacking which agency has primacy in China’s space activities is a difficult exercise given the level of opacity within China’s governmental and national security structures. US government documents argue that the People’s Liberation Army (PLA) is the historic and current dominant actor in China’s space program.4 The complex and interlocking array of agencies reflects the dual-use and sometimes ambiguous nature of China’s space program.

The largest proportion of China’s military space program falls under the auspices of the Strategic Support Force (SSF). Created in 2015, this force reportedly unifies the command of China’s information warfare capabilities and as result has responsibility for electronic and cyber warfare alongside the military satellite program. The full extent of the SSF’s control over Chinas military space program is unclear and it is likely that other military agencies maintain some responsibility for areas including the manned space program and missile defence.5

Although the civilian and international face of China’s space program is the China National Space Administration (CNSA), this organisation does not set space policy. Instead, it is China’s State Council, the country’s primary administrative body, that determines the ultimate direction of China’s space program. Within the State Council sits the State Administration on Science, Technology and Industry for National Defence (SASTIND) which is charged with coordinating and administrating State Council plans.

In 2014 China allowed private investment in space-related activity. While most companies involved in supplying state and military programs are state-owned enterprises, there are now several private companies seeking to exploit the commercial benefits of space operations. In 2018 iSpace became the first private Chinese enterprise to ‘successfully get beyond Earth’s atmosphere’ with the suborbital flight of the three nanosatellites.6 While still a small sector it is likely that private Chinese companies will have an increasing presence within China’s larger space architecture.7

Although China remains behind the US in terms of capabilities, Beijing continues to invest heavily in its space program and has set an ambitious target of becoming a major space power by 2045

Current Capabilities

In 2018, China broke its own record for the most launches into space in one year with 38 successful orbital launches (there was one failure). China has developed a series of reliable, increasingly cost effective and robust space launch vehicles which can reach low, medium and high earth orbits.8 The development of these launch vehicles has facilitated their increasingly sophisticated satellite and exploration program.

Satellites: As of December 2018, China had 284 satellites in orbit.9 These include 70 commercial and civil satellites mainly used for communications and earth observation. The military officially operates 100 satellites. Notable among them is the Yaogan series of ISR satellites with imaging and data collection capabilities. Additionally, the military has four dedicated communication satellites and several technology development and research satellites. The military also operates the indigenously designed and operated BeiDou Navigation Satellite System. This system provides China with an independent, dual-use navigation capability, ending China’s reliance on the US-controlled Global Positioning System (GPS). It is intended that BeiDou will have global coverage by 2020 with a planned 35 satellites in the system. The restricted or military component has an accuracy of up to 10 cm and can be used for navigation, weapons targeting and communications.

The state sector currently has 110 satellites used for communications, earth observation and science and technology. Government users include the China Meteorological Organisation, the China Ministry of Land and Resources, the State Oceanic Administration and the State Academy of Space Technology. Given the dominant role of the military in driving China’s space program these systems also likely have dual-use capabilities, particularly for surveillance and reconnaissance.

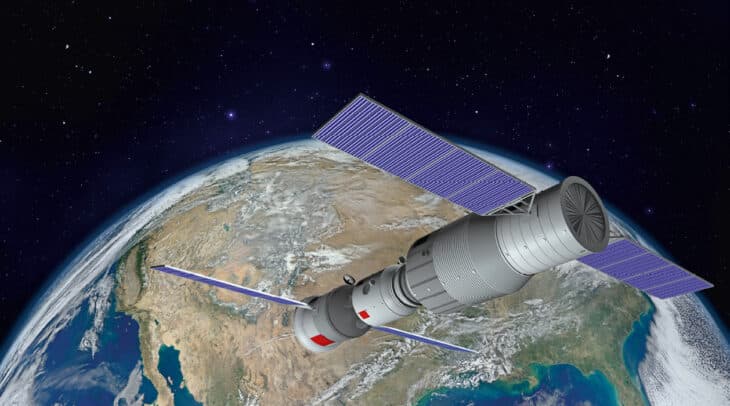

Exploration: Following the successful human spaceflight in 2003, China has incrementally expanded the sophistication of their manned space exploration program. Named the Shenzhou program, after the Shenzhou series of spacecraft, China has put 10 more astronauts into orbit. They have successfully launched and operationalised two limited life span space laboratories, Tiangong 1 & 2. There are current plans to construct a larger 80 to 100-ton manned space station with a completion date of 2023. The lunar exploration program (Chang’e project) also reveals a similarly deliberate process. Following a series of successful missions, future Chinese lunar missions will include sample-return missions, the landing of a robotic lunar laboratory and a potential manned lunar mission by 2030.

In 2017 China’s main space contractor, the China Aerospace Science and Technology Corporation (CASC) released a roadmap for future space technologies.10 It focused on a new set of capabilities including a super-heavy launch vehicle, a reusable space vehicle and even a nuclear-powered space vehicle all to be ready between 2030 and 2040. This fleet of vehicles is planned to facilitate a new set of missions including the exploration of the Moon and Mars, the extraction of minerals from the Moon and other celestial bodies and the development of a space-based solar power system which could wirelessly transmit solar energy to earth.11 While it possible this plan will fail to meet its targets, it is a demonstration of the long-term thought and ambition of China’s space program.

Space and Military Strategy

The military aspects of China’s space program form an important element of Beijing’s drive to transform its armed forces. Successive Chinese military strategies have placed an increasing emphasis on what the Chinese term ‘informatization’ or the use of technology as an integral part of information-centric joint operations.12 China is also redirecting of its armed forces away from ground operations and towards the maritime domain with an emphasis on preparing to win the ‘maritime military struggle’.13

The space program supports vital areas of this transformation. It bolsters China’s anti-access area-denial capability at sea and in the air. China is aware that it is an inferior military force when compared to that of the United States. It is developing a sophisticated network of asymmetric capabilities designed to deny the US and its allies’ operational freedom in its near abroad, namely in the East and South China Sea and into the Pacific Ocean. Space is vital for China’s C4ISTR capabilities. Satellites can provide consistent, real-time maritime domain awareness and are crucial enablers for targeting opposition platforms such as warships at distance with shore, sea and air-based cruise and ballistic missile systems. Space-based communication capabilities will also facilitate China’s increased operational emphasis on unmanned systems at sea allowing for remote command and control and the reception of real-time intelligence data.

Satellite systems will also support China’s growing international ambitions. While Chinese foreign deployments remain relatively small, if China’s current military trajectory continues and such deployments grow in frequency and sophistication, the requirement for advanced space communication capabilities will increase.

Importantly, China’s latest military strategy also looks on space not just as a facilitator but also as a domain of warfare. Counter-space capacity and the ability to disrupt US’ C4ISTR capabilities now forms a core part of Chinese military doctrine. General Hyten, the commander of US Strategic Command stated in a speech in 2017 that when it came to space, China was ‘the most aggressive nation in the world’ and that Beijing continuously tests counter-space technologies and will have the capability to threaten every US satellite in orbit. China has a sophisticated space tracking capacity and has openly demonstrated its ability to destroy satellites in orbit.14 In 2007 China performed a successful, if high-controversial test of an anti-satellite missile (ASAT). China is also developing jamming and hacking capabilities and is investing in directed-energy weapons. China is operationalising civilian satellites capable of grabbing other satellites and space debris while in orbit. It is feared that these platforms have dual-use potential to destroy other satellites if required.

For leaders in Beijing the operationalisation of an effective and advanced space program is seen as a requirement for a modern, developed state

Implications

While China has not yet reached the same level of sophistication as the US or other established space powers, the gap is rapidly closing. On the commercial side, competition should not be viewed as a negative, however it is inevitable that China will have an increasingly powerful voice in the setting the ‘rules of the road’ for future space use, particularly in new areas such as resource extraction. This makes it imperative that liberal space powers maintain investment and interest in space exploration.

On the military side, China’s gradual emergence as global military power requires the development of space-based military capabilities and therefore should be expected.

However, the reported development of counter-space capabilities is particularly threatening to core US and allied security interests. The public rationale for the US’ creation of a Space Force is to counter this capability. This indicates that space is becoming a new domain for competitive behaviour between Washington and Beijing. It is vital that not only the US, but also its allies such as Norway, prepare for the possibility of disruption to satellite networks, particularly if conflict broke out between the China and US. Such a disruption would not only impact military operations, but also everyday civilian life.

Barring some major economic or political shock, Beijing will continue to invest heavily in its space program. The US and its allies, including Norway need to prepare for this new reality and its potential consequences.